Money has metaphorical wings. One moment you can have it and the very next second it can fly away without any prior notification. To understand the nature and dynamic of cash, you need to know how to manage your money, and for that, you need to understand how to budget.

Money management is not a one-day task; it should be maintained regularly. That is why it is said that budgeting needs 90% of discipline and a mere 10% of knowledge. In money management, just 20% effort can generate 80% of the return.

Writing Your Budget

Keeping a record of every incoming and outgoing expenditure in mind can be quite challenging and could even be argued that it is not humanly possible! So, all financial information and transactions should be documented either in soft copy or hard copy.

You can write your budget on paper, on a spreadsheet, in a Word document, or even on a mobile budgeting app. Whatever route you take, just ensure you can keep track of and regularly update it.

Common Budgeting Methods

There are many budgeting methods that you can choose to follow when putting together your plan, however, here are the most common techniques:

1. 50 30 20 Rule

This is one of the easiest yet efficient ways to write a budget. With this budgeting method, you divide your income into three significant sections.

- Needs – 50% of total income should be used for essential needs like food, clothing, electricity, water, housing necessary, etc. It should cover all the requirements which are essential for your everyday living / “survival”.

- Wants – 30% of your income should be invested in the things which bring you joy and happiness. It could be funded for hobbies, cinema, live performances, or any other adventurous trip. We are human, and we have the right to be happy, so invest an amount for you and your happiness.

- Savings – The remaining 20% of income should be kept secure for the future. These savings can be a lifesaver in case of emergency, and it can also help you pay off debt. Otherwise, you can enjoy the perks of saving after retirement.

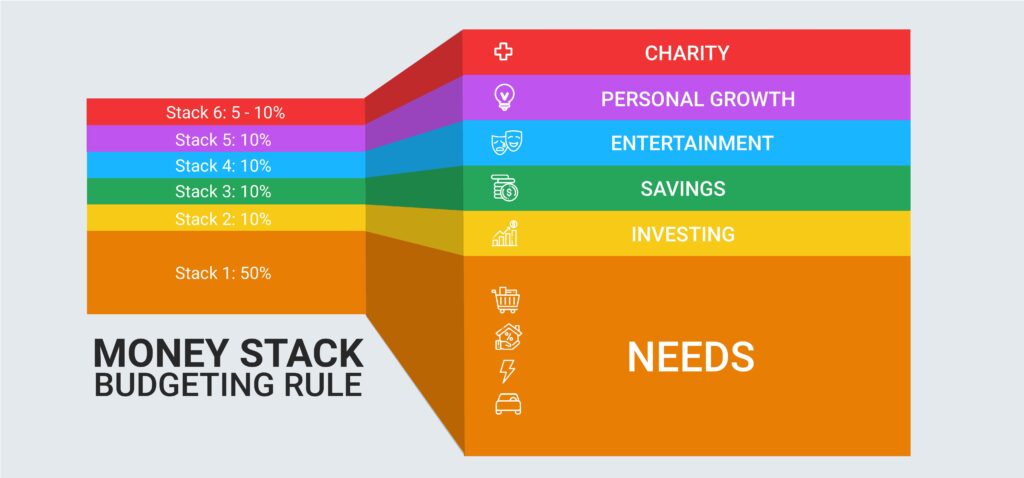

2. Money Stack Approach

Using this approach, your income should be categorised into six different categories. Every stack has its unique characteristics and features.

- Stack 1 – This is reserved for essential needs. 50 to 60% of the total income should be placed into this is stack. Traditional basic needs are food, shelter, and clothing. But in the modern era, education, sanitation, and healthcare can also be considered essential needs. The essential needs stack covers all the most uncomplicated, basic requirements which all humans need for routine living.

- Stack 2 – 10% of the total income should be invested on this stack. This will provide you financial independence. It is based on the idea that if you invest money smartly, your money will “work for you”. That means money will generate more money. So, 10% of income should be invested in services that will provide you great returns (e.g. the stock market.)

- Stack 3 – This is reserved for savings, which can also be considered a long-term investment. 10% of the total income should be kept away for long-term use, like saving for a mortgage deposit. If you have this stack, you do not need to rely on loans or borrowing money from others when the need arises.

- Stack 4 – This is your guilt-free stack which should be used for fun. You can spend 5 to 10% of your total income on your joy and happiness. It should cover expenses such as cinema, hobbies, and other ventures.

- Stack 5 – 5 to 10% of your income should be invested in personal growth and education. If you want to learn a new skill, want to attend a seminar or other online/offline courses, then this stack should be used to sponsor your growth.

- Stack 6 – 5 to 10% in this stack is reserved for charity. It works on the premise that if we are earning from society then it is our moral responsibility to give something back. It is up to you whether you need to maintain this stack or not.

3. Use an app or online budgeting tool

If you are not concerned with the ins and outs of your finances, there are several types of apps and online tools available for budgeting. Some popular free apps for budgeting include Emma, Yolt, and Money Dashboard to name just a few.

There are also several paid apps that provide you a platform for consolidating all your finances in one place and assist with budgeting, such as Money Hub. Many banks are also giving a platform for budgeting through their apps, such as Monzo and Starling Bank.

A great online tool to use is the budgeting calculator from Citizens Advice: https://www.citizensadvice.org.uk/debt-and-money/budgeting/budgeting/work-out-your-budget/

Why is budgeting essential?

Saviour in an emergency

We all know the age-old saying ‘life happens’ or ‘sod’s law’. If you have budgeted your finances well, you should always have enough in your account to use in case of an emergency. In other words, if life were to happen and you were to need cash urgently, you do not need to borrow it from others or take out a loan.

For stress-free life

This follows on from the previous point because if you stay on top of your finances and have an emergency fund, it will reduce your financial stress. You can sleep sound at night knowing you have everything under control.

Ease after retirement

By writing and maintaining a budget, you can help secure your future by saving money for retirement. I am sure it is fair to say that we would all love to retire early and with as much money as possible!

For writing a budget, you do not require a specific skill. You just needed patience, dedication, discipline, and a promise of using money in its best possible way.

James Banerjee is an Account Director who graduated from the University of Kent in 2014. He works in SEO on clients such as HSBC UK and Nestle and he has a keen interest in personal finances and money-saving advice.