When you have a debt problem, you must make every effort to eliminate the overhang as quickly and efficiently as possible. If not, you run the risk of not only credit damage, but financial distress, and worse, bankruptcy.

The total household financial debt in Great Britain was £119 Billion from April 2016 to March 2018.

The Office for National Statistics

So, with money being tight due to the pandemic and your finances limited, how can you possibly take steps to eliminate debt?

1. Review your budget

The first step is to review or create a budget plan. Do you have any unnecessary expenses that you can cut to free up cash for debt elimination? Maybe you could commit to not ordering takeout for a few months or making your morning coffee at home instead of grabbing it from Starbucks on your way to work.

This may sound harsh, but, if you donate to charities, can these payments be put on hold until after you are debt-free? Do you have many monthly subscriptions that you could suspend or temporarily cancel the services to avoid those extra expenses? Try to reduce your monthly outgoings as much as possible

2. Focus on paying off the high-interest debt first

If you can, restructure and simplify your budget to cut all unnecessary expenses until you have your debt under control. Once you have your cash flow maximized, identify the main debt, be it a credit card, loan, or overdraft, to pay off first. Our suggestion would be to start with the debt that has the highest interest rate first, simply because the monthly costs will be highest than the rest.

If your highest interest rate debt is also your largest debt and you have a constrained cash flow, this method may likely take a while before you can make significant progress if you start there first. In this instance, it would be better to start with the debt that has a lower balance.

3. Start overpaying your identified debt

Pay your usual obligations as required but use all money you have spare on overpaying the debt you identified. Making these increased payments will help you eliminate it rapidly. Once you have paid that debt in full, you have one less commitment to worry about.

The money you ‘save’ from this can be used to pay off the next credit card, loan, or overdraft debt on your list. You then keep working up the ladder until each is paid off to become the conqueror of debt!

4. Avoid taking out additional credit

Once you have paid off all, or even one, of your debts, you should try to avoid taking out any additional credit or using a credit card as much as possible. This is to help prevent jumping back into the debt loop and ending up back at square one.

£2,177 was the average credit card debt per household in October 2020

Themoneycharity.org

We understand that there may be situations where you need to use your credit card, therefore we can only suggest you buy what is essential and pay back the amount borrowed as soon as possible.

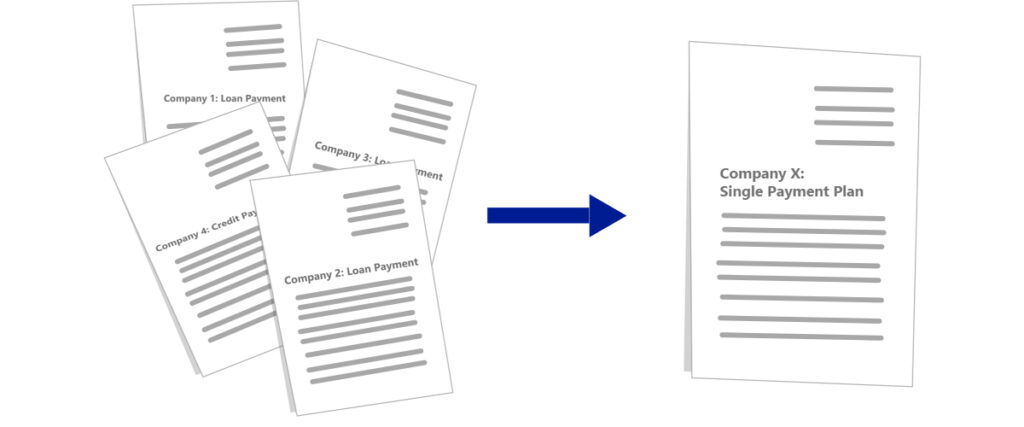

5. Consider debt consolidation

If you are struggling to handle your debt pile in this way, you should consider alternative repayment methods. Debt consolidation is a service offered by many which allows you to combine multiple unsecured debts into one monthly payment with low interest. You pay less each month but pay over a longer period. It can be beneficial if you are struggling financially as interest does not build as fast.

If you have excellent credit scores, you can consolidate debt on your own. Otherwise, contact a credit counselling agency to discuss options for debt relief with a trained credit counsellor.

You should also be aware that going down this route has the potential to have both a positive or negative impact on your credit score, dependent on the strategy and payment plan used.

James Banerjee is an Account Director who graduated from the University of Kent in 2014. He works in SEO on clients such as HSBC UK and Nestle and he has a keen interest in personal finances and money-saving advice.